Featured News - Current News - Archived News - News Categories

Submitted by the Office of New York State Comptroller Thomas P. DiNapoli

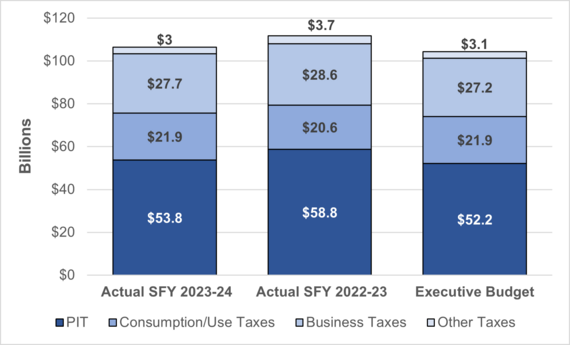

Tax collections for state fiscal year (SFY) 2023-24 totaled $106.4 billion, over $2 billion higher than forecast by the Division of the Budget (DOB) in the most recent financial plan, according to the March state cash report released Monday by New York State Comptroller Thomas P. DiNapoli. Tax receipts also exceeded the projection in the consensus economic and revenue forecast report, which estimated $1.35 billion in additional receipts above DOB estimates through the end of SFY 2024-25.

Tax collections for SFY 2023-24 were $5.2 billion lower than the previous year, due, in part, to a decline in personal income tax (PIT) receipts resulting from lower middle-class tax rates and lower payments related to tax year 2022 annual returns.

“With an economy that performed better than expected, the state’s tax collections outpaced forecasts,” DiNapoli said. “The pace of inflation and Federal Reserve Board interest rate decisions will continue to impact economic growth in the coming fiscal year. State policymakers should ensure that the enacted budget for state fiscal year 2024-25 accounts for such risk.”

Image courtesy of the Office of New York State Comptroller Thomas P. DiNapoli

••••••••

PIT collections totaled $53.8 billion, $4.9 billion (or 8.4%) lower than prior year collections. The decline was primarily attributable to lower tax rates and the timing of payments. PIT collections exceeded the most recent financial plan projections by $1.6 billion, as receipts from estimated payments and withholding in the final quarter of the year were higher than DOB forecast.

Consumption and use taxes, which includes sales tax, totaled $21.9 billion, exceeding the prior year total by $1.3 billion (or 6.2%). Collections were $70.4 million lower than DOB’s latest projections.

Business tax collections totaled $27.7 billion, which was $922.2 million lower than the previous year, primarily reflecting a nearly $1 billion decrease in pass through entity tax receipts as well as the absence of audit collections from the repealed bank tax. Total business tax collections exceeded DOB’s latest projections by $527.2 million.

All funds spending totaled $234.9 billion, which was $14.4 billion (or 6.5%) higher than last year. The general fund ended the fiscal year with a balance of $46.3 billion, an increase of $2.9 billion from the opening balance. Major actions taken by DOB at the end of the fiscal year include:

√ $4.7 billion in debt service prepayments.

√ Transferring $2.25 billion of federal funds from the American Rescue Plan state fiscal relief program to the general fund, leaving approximately $4.2 billion remaining.

√ The deferment of nearly $3.2 billion in Medicaid provider payments from March to April, including $1.4 billion of state share payments, continuing a multi-year pattern.

See also: March Cash Report