Featured News - Current News - Archived News - News Categories

Federal and state tax credits can add up to almost $7,000 in EITC refund

Submitted by Erie County Clerk Michael P. Kearns

If you worked in the past year and earned $59,187 or less, you can get your federal and state taxes e-filed for free, and you may qualify for the Earned Income Tax Credit (EITC). That is why I am pleased that the Erie County Clerk’s Office is raising awareness of the critical support of the United Way’s MyFreeTaxes program.

The Volunteer Income Tax Assistance (VITA) program provides low and moderate-income individuals and families with reliable assistance by opening access to tax credits and other benefit programs, and offering free tax preparation services to help working families and individuals file tax returns. Let VITA help you navigate through the somewhat confusing aspects of tax preparation including applying for the Earned Income Tax Credits.

If you are not familiar with the Earned Income Tax Credit, here is some basic information.

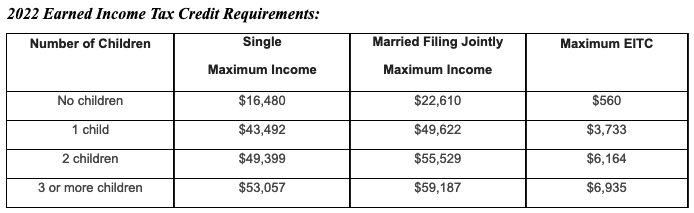

The EITC is a federal tax benefit that was created by the federal government in 1975 to benefit low-income and working families in an effort to reduce poverty and grow the economy. It is a refundable credit based upon your earned (W-2) income and it usually increases as you add qualified dependents. Here is how it works. EITC recipients can receive up to $6,935. However, the exact amount will depend on the situation of each family or individual applying, such as the number of children one has or annual income.

To qualify for the EITC, you must meet the basic qualifying rules which include:

√ Have worked and earned income under $59,187;

√ Have investment income below $10,300 in the tax year 2022;

√ Have a valid Social Security number by the due date of your 2022 return (including extensions);

√ Be a U.S. citizen or a resident alien all year; and

√ Not file Form 2555 (related to foreign earned income).

The IRS estimates that four out of five workers claim the EITC, which means millions of taxpayers are putting EITC dollars to work for them. Nationwide last year, close to 31 million eligible working families and individuals received nearly $64 billion in EITC. The average amount of EITC received nationwide was $2,043, and in New York state the average amount was $2,400. Those EITC dollars had a significant impact on the lives and communities of the nation’s lowest-paid working people who are struggling to make ends meet.

If you think you may qualify for the Earned Income Tax Credit, I encourage you to have your return prepared through the IRS’ VITA program before the electronic filing deadline of April 18. Call 2-1-1 to make an appointment and find a free tax preparation site near you, call the main MyFreeTaxes helpline at 1-866-698-9435, or visit myfreetaxes.com to get started.