Featured News - Current News - Archived News - News Categories

Fact sheet details programs available to help local organizations

Congressman Brian Higgins is providing details on the programs made available through the Coronavirus Aid, Relief, and Economic Security (CARES) Act to help nonprofit organizations respond to and recover from the COVID-19 outbreak.

“Many of our nonprofit agencies are actively working to respond to the needs of our community during this health crisis: feeding the hungry, supporting families, helping the homeless and serving in various other capacities,” Higgins said. “The resources available help support staffing and continued operations during the public health emergency.”

Higgins created a fact sheet that summarizes the resources available for non-profits. Below is an expanded version of what is included in the fact sheet:

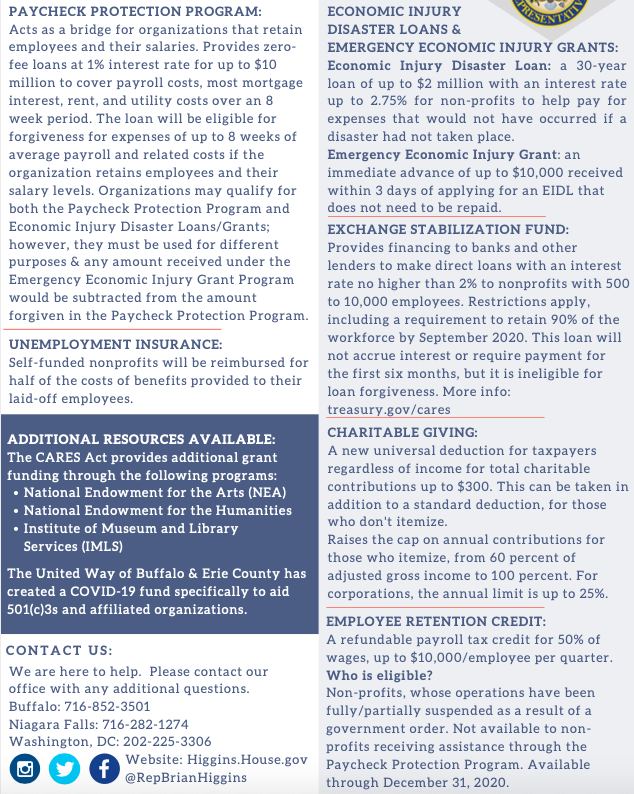

Paycheck Protection Program: The CARES Act included $350 billion in financial assistance called the Paycheck Protection Program (PPP), which acts as a bridge for 501(c)(3) nonprofits that retain employees and their salaries. PPP will provide zero-fee loans at 1% interest rate of up to $10 million that cover payroll costs, and most mortgage interest, rent and utility costs over an eight-week period. No personal guarantee or collateral is required to secure the loan. The loan is eligible for forgiveness if used as prescribed, while also maintaining staff and salary levels.

Further guidance on the Paycheck Protection Program from the Treasury Department is available at: https://home.treasury.gov/system/files/136/PPP--Fact-Sheet.pdf.

Economic Injury Disaster Loan: The CARES Act included $10 billion for economic injury disaster loans (EIDL) and emergency economic injury grants, programs for nonprofits that experienced significant economic injury and are located in a declared disaster area, which includes the entire state of New York.

An EIDL is a 30-year loan of up to $2 million with an interest rate up to 2.75% for nonprofits to help pay for disaster-related expenses. An emergency economic injury grant is an immediate advance of up to $10,000 received within three days of applying for an EIDL that does not need to be repaid, even if the business fails to qualify for the EIDL.

Local small business development centers can provide Western New York nonprofits with additional guidance. For Erie County, visit https://sbdc.buffalostate.edu/ or call 716-878-4030. In Niagara County, go to http://niagarasbdc.org or call 716-210-2515.

Exchange Stabilization Fund: The CARES Act established a program to provide financing to banks and other lenders to make direct loans with an interest rate no higher than 2% to nonprofits with 500 to 10,000 employees to support their operations. There are several restrictions associated with this loan, including a requirement to retain 90% of the workforce by September 2020. This loan will not accrue interest or require payment for the first six months, but it is ineligible for loan forgiveness. For further information, visit https://home.treasury.gov/cares.

Employee Retention Tax Credit: The CARES Act created an employee retention tax credit, a refundable payroll tax credit for 50% of qualified wages paid by eligible employers for up to $10,000 per employee per calendar quarter, including tax-exempt organizations, to employees during the COVID-19 crisis. Nonprofits are not eligible for the credit, if they are participating in the Paycheck Protection Program. More information on the employee retention tax credit is available at: https://www.irs.gov/newsroom/faqs-employee-retention-credit-under-the-cares-act.

Unemployment Insurance: Self-funded nonprofits will be reimbursed for half of the costs of benefits provided to their laid-off employees.

Charitable Giving: CARES Act creates a new universal deduction for all taxpayers regardless of income for total charitable contributions up to $300. This can be taken in addition to your standard deduction, if you do not itemize.

It also raises the existing cap on annual contributions for those who itemize, from 60% of adjusted gross income to 100%. For corporations, the annual limit is up to 25%.

Student Loans: The Cares Act pauses payments on all federal student loans held by the U.S. Department of Education until September 2020. Borrowers working at 501(c)(3) organizations will still be able to count these paused payments toward their 10-year payment term under the Public Service Loan Forgiveness Program.

Additional Resources

United Way of Buffalo & Erie County: The United Way of Buffalo and Erie County is a resource for nonprofits during the COVID-19 pandemic, and has created a COVID-19 fund specifically to aid 501(c)(3)s and affiliated organizations. For more information, click here.

National Endowment for the Arts: NEA will provide additional funding to arts organizations to support general operating expenses, a departure from the Arts Endowment’s requirement of supporting project-based funding and an acknowledgment of the dire situation facing the arts community. For more information, click here.

National Endowment for the Humanities: NEH was granted an additional $75 million to support state humanities councils and at-risk humanities positions and projects at museums, libraries and archives, historic sites, colleges and universities, and other cultural nonprofits that have been financially impacted by the coronavirus. For more information, click here.

Institute of Museum and Library Services: IMLS will offer funding to enable libraries and museums to respond to the impacts of coronavirus by expanding digital network access, purchasing internet-accessible devices, and providing technical support services to their communities. For more information, click here.

Visit Higgins website for a COVID-19 relief fact sheet for nonprofits and additional fact sheets for families, small businesses, students and seniors: https://higgins.house.gov/issues/coronavirus-disease.