Featured News - Current News - Archived News - News Categories

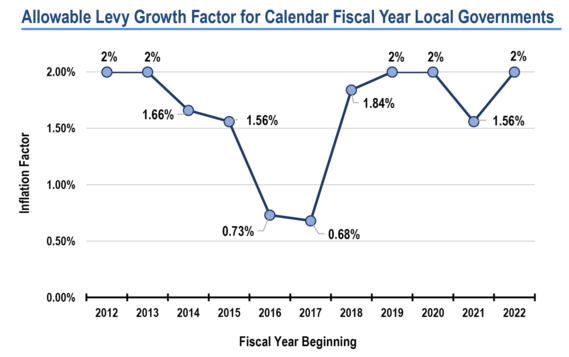

Property tax levy growth will be capped at 2% for 2022 for local governments that operate on a calendar-based fiscal year, State Comptroller Thomas P. DiNapoli announced. This figure affects tax cap calculations for all counties, towns and fire districts, as well as 44 cities and 13 villages.

"Allowable tax levy growth will be limited to 2% for a third time in four years for local governments with calendar fiscal years," DiNapoli said. "As the economy recovers from the pandemic, local governments have seen some revenues rebound and have benefited from one-time federal financial assistance. At the same time, the risk of inflationary cost increases and the need for investments that will stimulate economic growth and fund essential services may lead to challenging budget decisions ahead.”

The tax cap, which first applied to local governments and school districts in 2012, limits annual tax levy increases to the lesser of the rate of inflation or 2% with certain exceptions, including a provision that allows municipalities to override the tax cap.

The 2% cap for the 2022 fiscal year is the third time since 2019 that municipalities with a calendar year fiscal year (Jan. 1 through Dec. 31) had their levy growth capped at that amount. In 2021, the allowable levy growth was 1.56%.

Image courtesy of the Office of the State Comptroller

••••••••

The Office of the State Comptroller has created a financial toolkit containing resources that can be useful to local officials in the wake of COVID-19 pandemic.