Featured News - Current News - Archived News - News Categories

Congressman releases ‘Relief for Seniors’ fact sheet

Congressman Brian Higgins, D-NY-26, and his colleagues on the House of Representatives Ways and Means Subcommittee on Social Security requested and won agreement by the U.S. Department of Treasury to automatically provide stimulus checks to senior citizens who are Social Security recipients – reversing course on previous directives that would have required seniors to complete forms to receive the COVID-19 relief payment.

IRS guidance issued on March 30 stated: “People who typically do not file a tax return will need to file a simple tax return to receive an economic impact payment. Low-income taxpayers, senior citizens, Social Security recipients, some veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax.”

Higgins and other members of the Ways and Means Committee objected to this requirement, which would have created additional hurdles and delayed payments for seniors. In a letter to the Treasury secretary, the members wrote: “We are extremely displeased to see the IRS guidance recently notifying the public that Social Security and Supplemental Security beneficiaries who did not file tax returns in 2018 or 2019 must file a return in order to get the rebate. This requirement presents substantial and unnecessary hardships for these beneficiaries and delays critical relief for our most vulnerable citizens.”

On Wednesday, the U.S. Treasury announced it would no longer require Social Security beneficiaries to file an abbreviated tax return to receive an economic impact payment. Instead, payments will be automatically deposited into their bank accounts.

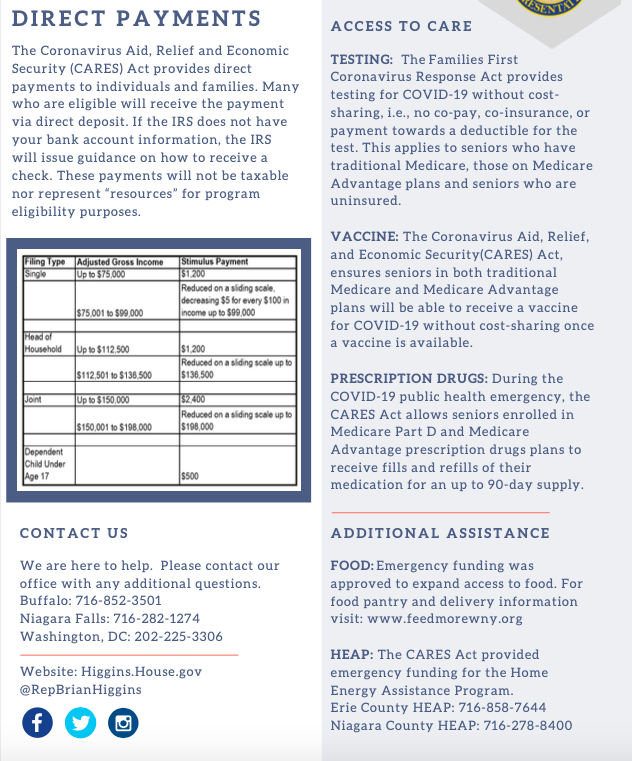

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, approved by Congress, authorizes a one-time automatic payment to most Americans as the nation confronts the COVID-19 pandemic. The Internal Revenue Service will disburse a $1,200 payment to every eligible adult ($2,400 for joint filers), plus an additional $500 per dependent child under 17. These payments gradually phasedown for individual incomes exceeding $75,000, $112,500 for head of households, or $150,000 for joint filers.

A summary of COVID-19 relief available to seniors can be found in a fact sheet on Higgins’ website at: https://higgins.house.gov/issues/coronavirus-disease.