Featured News - Current News - Archived News - News Categories

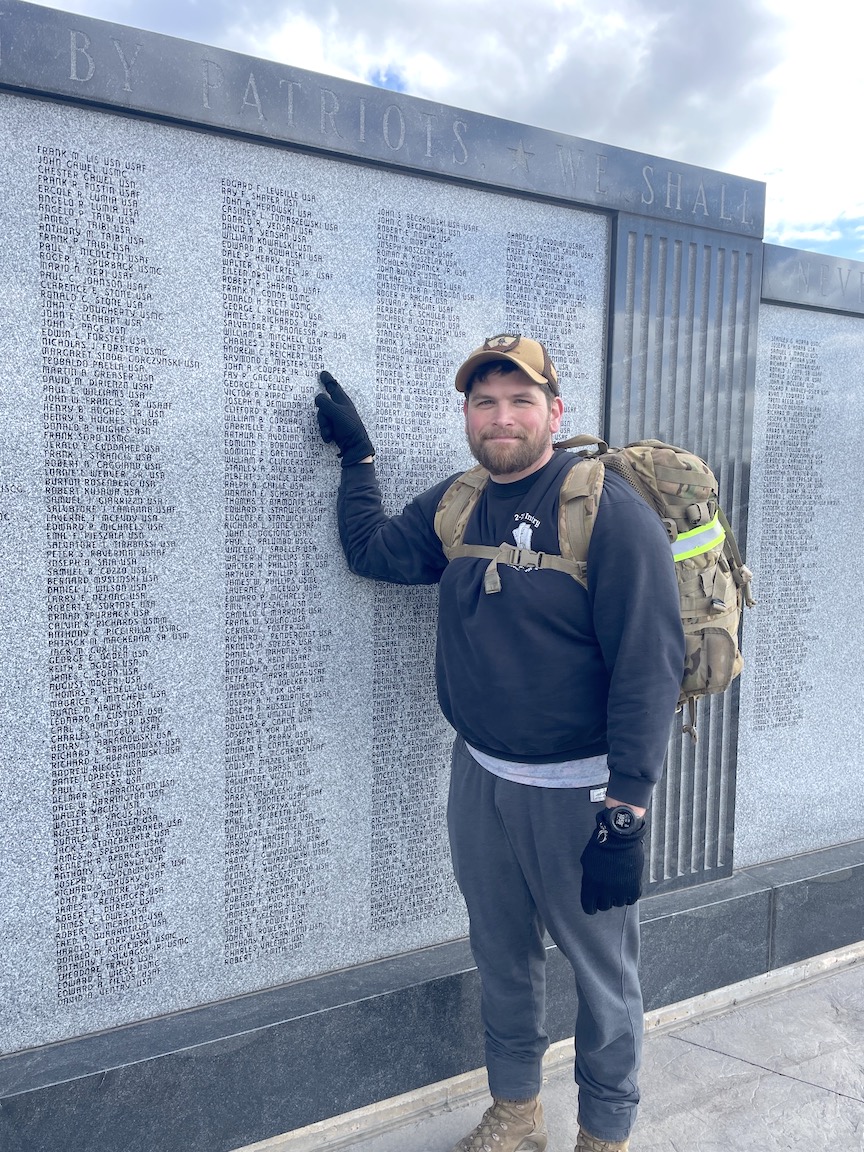

With Veterans Day coming, New York State Comptroller Thomas P. DiNapoli today spotlighted the availability of $4 million in competitive fixed-rate small business loans for military veterans through the New York Business Development Corp.

"Our freedoms are protected because of the brave men and women of our armed forces. Their dedication and discipline make a difference in the lives of all Americans, and we must do all that we can to show our appreciation," DiNapoli said. "The veterans program helps to address the financial hardships of active duty with loans to small businesses owned by military veterans for working capital and expansions."

The New York State Common Retirement Fund provides funds to the New York Business Development Corp. to make loans to New York-based small businesses for working capital, equipment or real property. Since 1987, NYBDC has used these funds to make more than 1,000 loans totaling $324 million to small businesses across the state. The loans are also guaranteed by the Small Business Administration.

Working with NYBDC, DiNapoli designated $5 million for veteran-owned businesses administered by NYDBC. There is $4 million remaining in available funding through the program.

For information about the program

and company eligibility, visit:

http://www.nybdc.com/how-can-we-help/PB2a_Loans_for_Veterans_69_7_sb.htm

The $160.7 billion New York State Common Retirement Fund is the third largest public pension plan in the U.S., with more than 1 million members, retirees and beneficiaries from state and local governments. The fund has a diversified portfolio of public and private equities, fixed income, real estate and alternative instruments.

NYBDC's mission is to promote economic activity and opportunity within New York state by providing innovative loans to credit-worthy small businesses that are unable to access capital at reasonable rates and terms from conventional sources; and, particularly, to assist minority and women-owned businesses by offering credit opportunities not otherwise available to them.