Featured News - Current News - Archived News - News Categories

Despite state mandates, taxes 12 percent lower than decade ago

by Christian W. Peck

Public Information Officer

Niagara County Public Information Office

Niagara County lawmakers approved a $336 million spending plan Tuesday night in Lockport that marginally bumps taxes 6 cents higher - despite a $2.3 million hike in county spending on an Albany-mandated welfare program

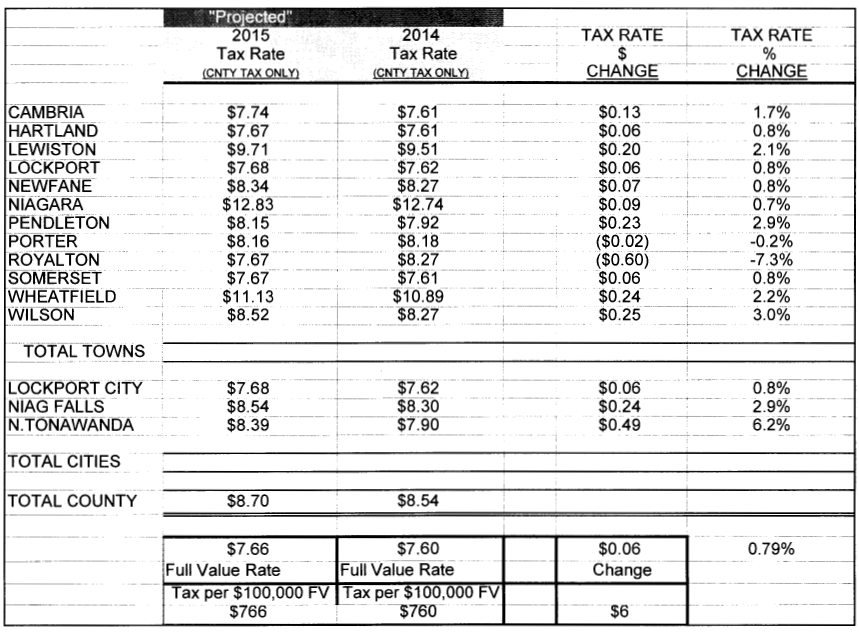

The approved budget sets a full value tax rate of $7.66 per $1,000 of assessed value, up 6 cents, or .79 percent, over last year's rate. It remains lower than the $7.72 rate set in the 2013 spending plan. More significantly, despite the minimal uptick in rates, the fiscally conservative budget maintains deep cuts in county tax rates achieved over the course of the past decade, with taxes still sharply lower than the $8.71 per $1,000 rate set in 2005.

The budget passed the 15-member Niagara County Legislature by an 11-4 vote.

Despite passing the spending plan, county leaders remain distraught over a surge in costs to fund the state-mandated "Safety Net" public assistance program brought about by unilateral changes in state funding levels beginning in the 2011 New York state budget. While the state formerly funded 71 percent of the cost of that program, beginning in 2011, Gov. Andrew M. Cuomo's executive budget changed the state funding level to 50 percent - meaning county taxpayers have to make up the difference in the program.

County lawmakers also approved by an 11-4 vote a plan to provide 75 percent of the county's share of Seneca Niagara Casino slot machine revenues to the county's 12 towns and the cities of North Tonawanda and Lockport for tax relief, while devoting the remaining 25 percent to economic development efforts.

The City of Niagara Falls receives its share of casino funds directly from New York state, while the portion for residents of the 14 other municipalities is appropriated to the county under Section 99-h of New York State Finance Law, which governs appropriations of funds generated under the Tribal-State Class III Gaming Compact.

The 2015 budget also restores step increases to unionized county employees.

"This budget accomplished several significant goals, including direct tax relief to residents of the municipalities outside Niagara Falls," said Legislature Majority Leader Rick Updegrove, R-Lockport, following the budget's passage. "It should be noted, however, that Gov. Cuomo could lower the costs borne by Niagara County taxpayers by $2.3 million by simply restoring the previous 'Safety Net' funding levels and not passing costs on to county taxpayers for a program that Albany mandates."

A table containing municipal tax rates, based upon the separate municipalities' equalization rates, is below.